types of government expenditure in malaysia

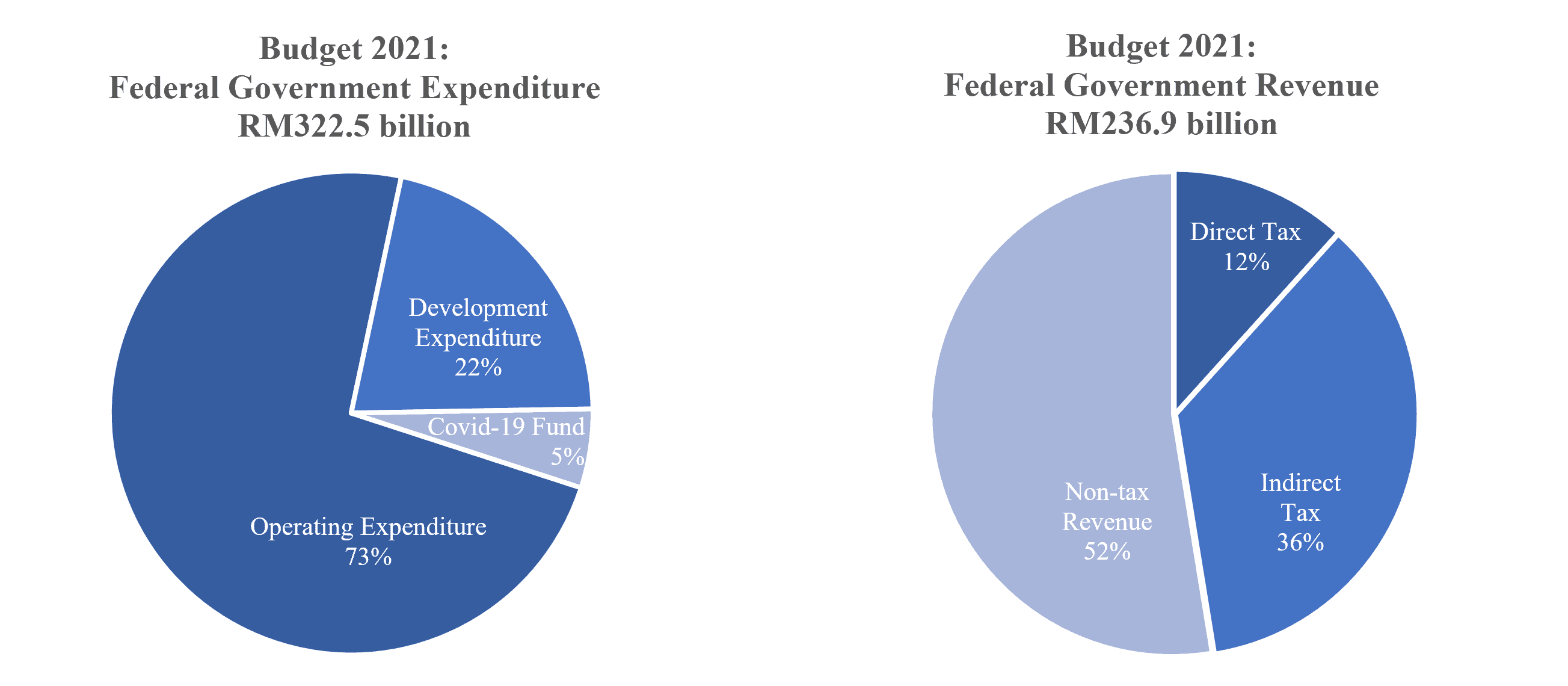

Here is the List of Malaysia Budget by the Malaysia Finance Minister In a countrys finance the period covered by a budget is usually a year which is usually known as a financial or fiscal year. Federal Government Expenditure Overview The global COVID-19 pandemic has forced most Governments to implement countercyclical.

Malaysia Ratio Of Government Expenditure To Gross Domestic Product Gdp 2027 Statista

Suppose more realistically that the tax revenue is used to finance government expenditures.

. Meanwhile Sinha 1998 found positive relationship between economic growth and government expenditure in Malaysia for the period of 1950-1992. Which the total cost is the largest in Malaysias fiscal history. Government Spending in Malaysia averaged 3190074 MYR Million from 2005 until 2022 reaching an all time high of 58164 MYR Million in the fourth quarter of 2021 and a record low of 12420 MYR Million in the first quarter.

The share that DE took of the total budget had fallen from 278 in 2010 a year into Najibs tenure to a paltry 17 in Budget 2018. Apart from being on an accrual. The amount of interest depends on the total federal debt and interest rates.

Over the past 58 years the value for this indicator has fluctuated between 45059430000 in 2014 and 237488600 in 1960. The ability to implement these measures was due to the availability of fiscal space following concerted fiscal consolidation. Government expenditure refers to the spending on goods and services by the government.

In 2020 the expenditure of the government in Malaysia on social services amounted to around 9193 billion Malaysian ringgit. Examples are purchasing goods for operations and investing in public goods. Jan 19 2022.

General government final consumption expenditure formerly general government. Summary table for developing countries 24-25. - 2020 revenue collection to fall 71 to 24453 billion ringgit 5844 billion - 2020 expenditure seen at 29702 billion ringgit for expenditure down from 316 billion ringgit in 2019.

Government Spending in Malaysia decreased to 45649 MYR Million in the first quarter of 2022 from 58164 MYR Million in the fourth quarter of 2021. The latest value for General government final consumption expenditure current US in Malaysia was 42863370000 as of 2018. On paper such a decreasing trend of DE is fine if Malaysia has already achieved the status of a high.

Fiscal Expenditure in Malaysia averaged 2512504 MYR Million from 1981 until 2021 reaching an all time high of 6977240 MYR Million in the fourth quarter of 2019 and a record low of 2759 MYR Million in the first quarter of 1981. If spending exceeds revenue the government runs a fiscal deficit. A number of possibilities exist.

Total Development Expenditure 2004 to 2018. The federal budget includes the governments estimates of revenue and spending and may outline new policy initiatives. Level 6 Setia Perdana 2 Setia Perdana Complex Federal Government Administrative Centre 62502 Putrajaya Malaysia.

Also some expenses do not involve the exchange of goods and services ie transfer payments. The combined distributional effect of the tax-and-expenditure policy is commonly referred to as balanced-budget incidence which obviously depends on the particular expenditures being financed. Summary table for developed countries 19 -20 Table 3.

Approximately two-thirds of spending consists of mandatory expenditures on programs such as Social Security and Medicare. Fiscal Expenditure in Malaysia increased to 6348130 MYR Million in the fourth quarter of 2021 from 5066730 MYR Million in the third quarter of 2021. DE dropped by 10 in absolute terms from 2009.

The government budget as forecasted by a government of its expenditures and revenues for a specific period of time has come to be used to achieve. In 2020 general government total expenditure for Malaysia was 360 billion LCU. Total expenditure consists of total expense and the net acquisition of non-financial assets.

These finding may give some overview of policy implications to the Malaysia policymakers on optimizing the effects of government expenditure in economic growth. Types of Government Expenditure in Malaysia 9 Table 2. General government total expenditure of Malaysia increased from 108 billion LCU in 2001 to 360 billion LCU in 2020 growing at an average annual rate of 670.

In Malaysia the government expenditures are allocated for programmes projects and activities implemented to achieve government policy objectives and. In Malaysia federal budgets are presented annually by the Government of Malaysia to identify proposed government revenues and spending and forecast economic conditions for the upcoming year and its fiscal policy for the forward years. By comparison the government spent around 1621 billion.

That leaves just 20 to 30 percent of expenditures that are discretionary and can be changed in the governments annual budget. Landau 1983 studies noticed that the effect of government expenditure on economic growth in 96 countries and finds a negative relationship between government spending and economic growth.

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

Malaysia Government Spending On Environmental Protection By Method 2019 Statista

Malaysia Defense Privacy Shield

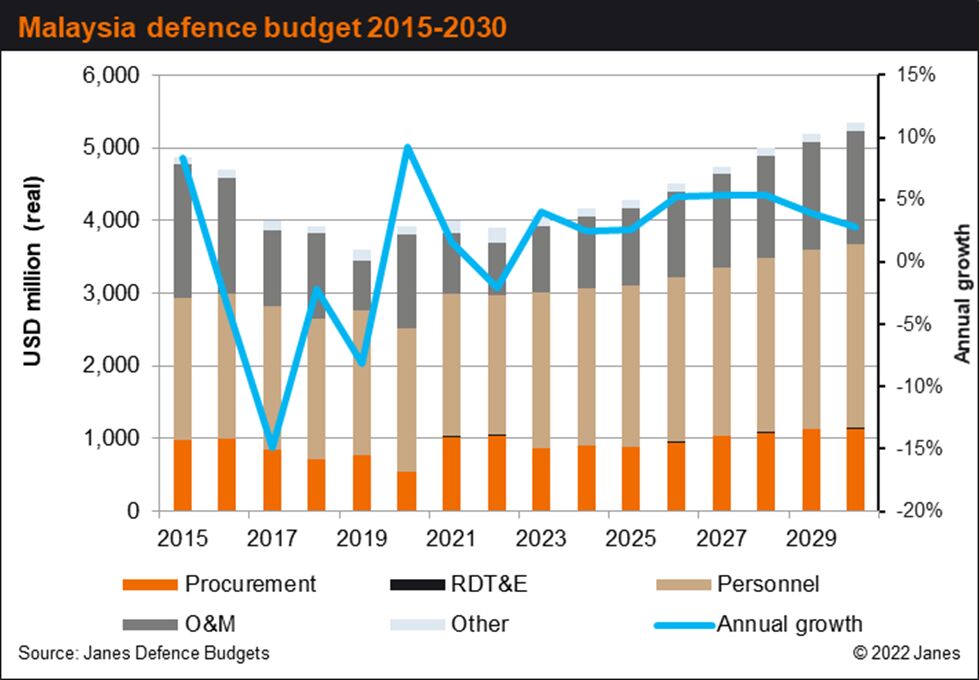

Update Malaysia Proposes Usd3 9 Billion Defence Budget For 2022

Pdf Government Expenditures And Economic Growth Evidence From Malaysia

Pdf Towards Stabilizing The Economic Impact Of Covid 19 Through Fiscal Policy In Malaysia

Malaysia Resources And Power Britannica

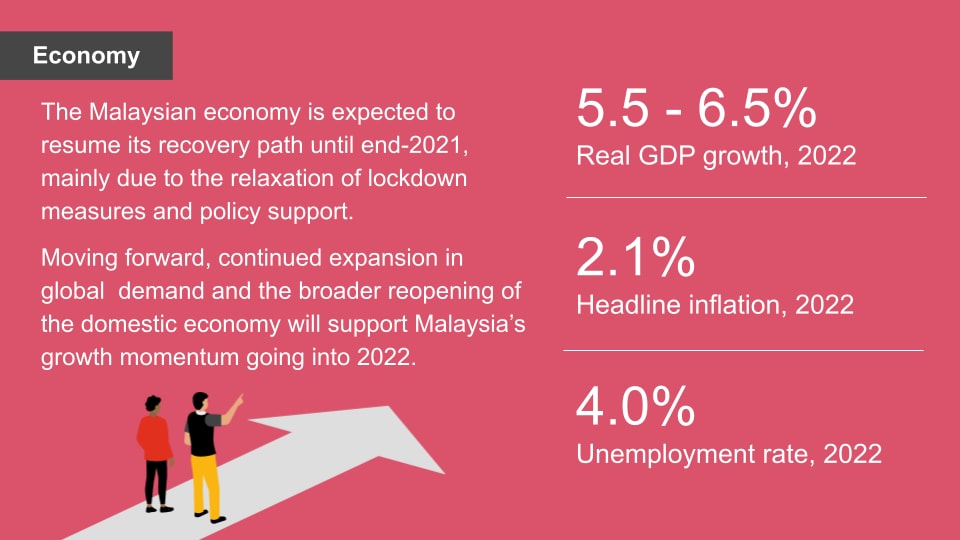

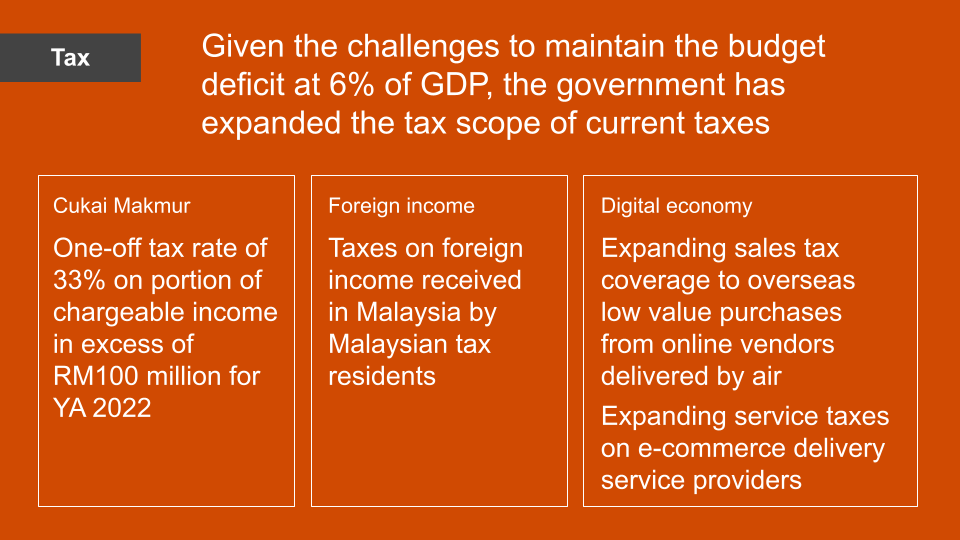

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note

Types Of Government Expenditure And Data Of Malaysia S Government Expenditure Youtube

Dsa 2022 Malaysian Military Modernisation Poised To Pick Up Pace

Oil And Gas Industry Gas Compressor Market Growth Trends And Forecast 2022 27 Gas Industry Gas Oil And Gas

No comments for "types of government expenditure in malaysia"

Post a Comment